The global industrial robot market is in a stage of long-term steady growth, and the number of co-robots is growing rapidly

Date:2020-11-30

At present, the global industrial robot market is in a stage of long-term steady growth, but the global economic downturn and trade frictions in 2019 have brought a certain impact on the robot industry.

According to the latest report of IFR (International Federation of Robotics), in 2019, the global sales of new robots remained at a high level, with global shipments of 373,000 units. Compared with 2018, the decline was 12% year-on-year. The main reason for the decline was the continued downturn in the two major downstream industries: automotive and electrical/electronics. However, it was still the third-highest sales volume on record. The compound growth rate from 2014 to 2019 was 11%.

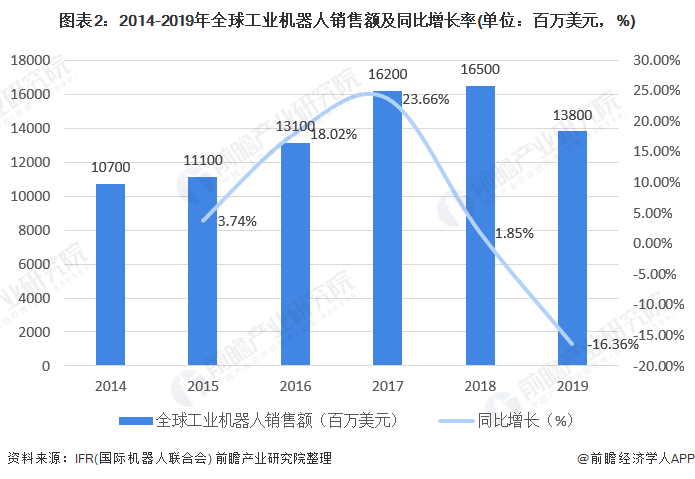

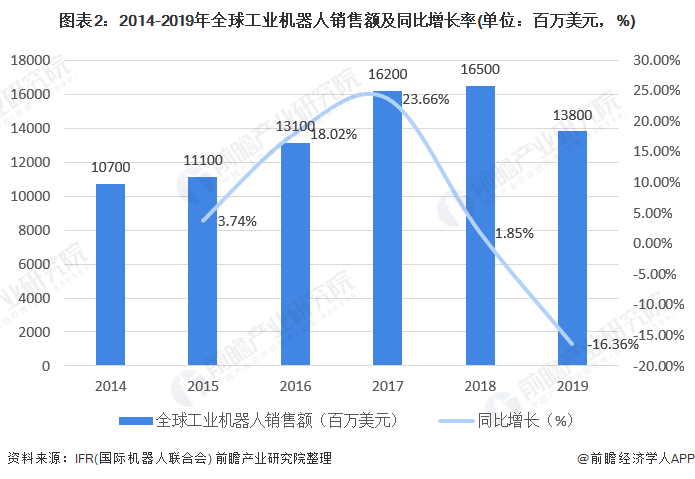

Industrial robots continue to integrate with emerging technologies such as big data, artificial intelligence, and 5G, pushing the industry into a fast track. From 2014 to 2018, the global sales of industrial robots showed an overall growth trend. In 2019, the global sales of industrial robots declined slightly, with sales of 13,800 million U.S. dollars, a decrease of 2,700 million U.S. dollars from the previous year, and a year-on-year decrease of 16.36%.

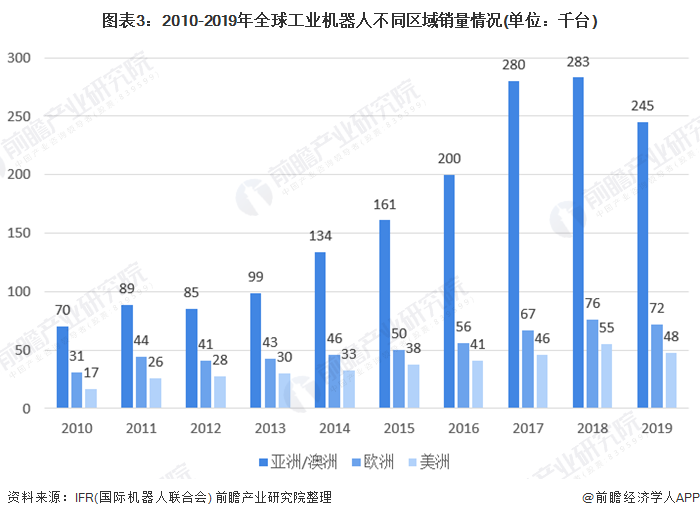

The Asia-Pacific region is the world's largest market for industrial robots

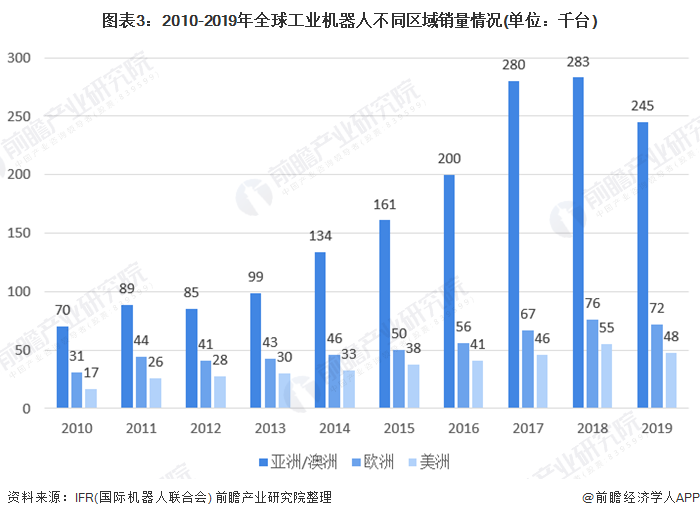

Due to the vigorous development of the automotive industry in developing countries such as China, Japan, and India, the Asia-Pacific region is the world's largest industrial robot producer and employer. In Asia, the share of newly installed robots accounts for about 2/3 of the global supply. In 2019, the sales of industrial robots in Asia/Australia reached 245,000 units; Europe is the second-largest market for industrial robots, with sales of 7.19 in 2019 Ten thousand units; the market share of industrial robots in the Americas is the smallest, with sales of 47,800 units in 2019.

From a national perspective, the global robot consumer market is highly concentrated. In 2019, sales in major countries such as China, Japan, the United States, South Korea, and Germany accounted for 73% of global sales. China is the main end-use market for industrial robots, with 141,000 new installations annually, followed by Japan and the United States with 49,900 and 33,000 units respectively.

Singapore and South Korea lead the world in installed density

From the perspective of the installed density of robots, the global installed density of industrial robots was 113 units per 10,000 people in 2019. Singapore and South Korea are the markets with the highest installed density of robots. The number of installed robots per 10,000 people reached 918 and 855, respectively. The number of the largest Chinese market is only 187 units, which is far behind the developed countries, and there is still much room for improvement in the future.

Asia/Australia holds the largest number of industrial robots

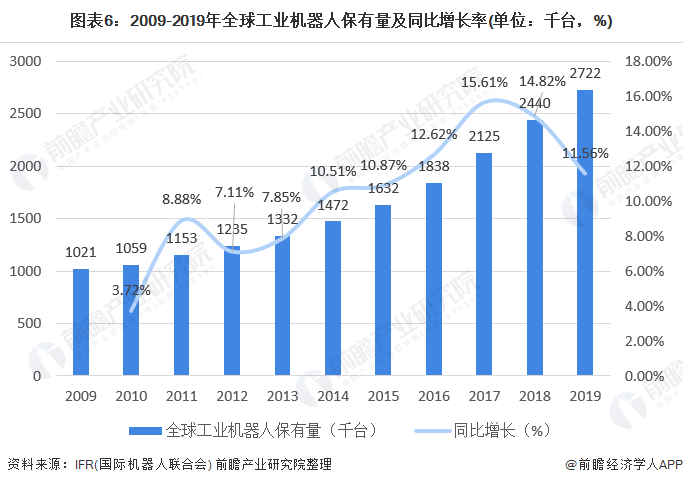

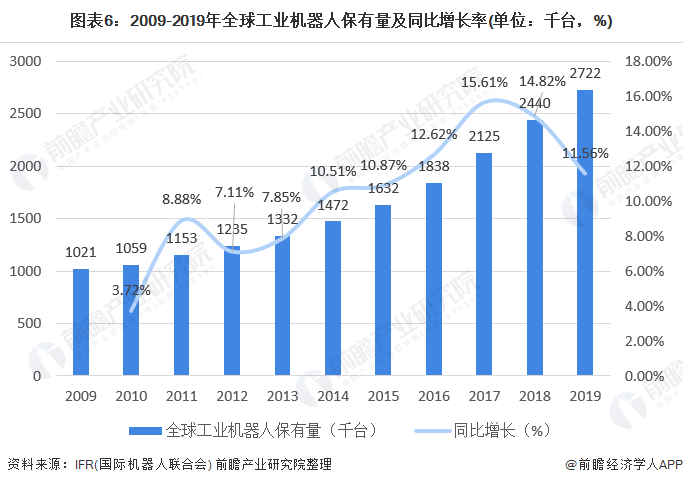

According to the latest statistics from the International Federation of Robotics (IFR), as of the end of 2019, the number of industrial robots in the world reached 2.72 million units, a year-on-year increase of 11.6%.

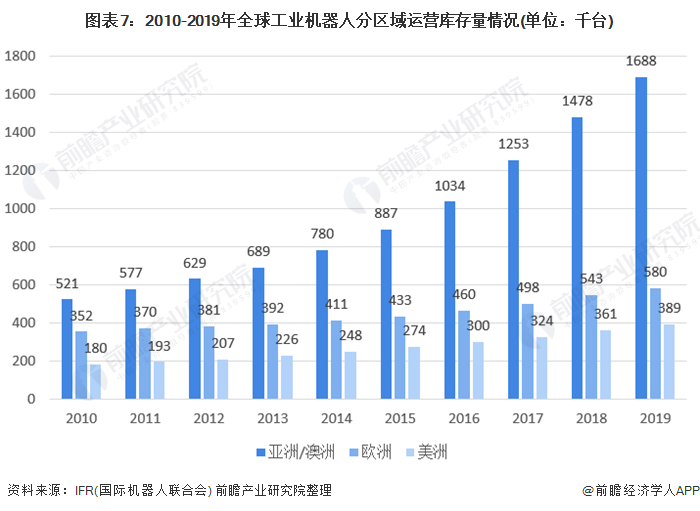

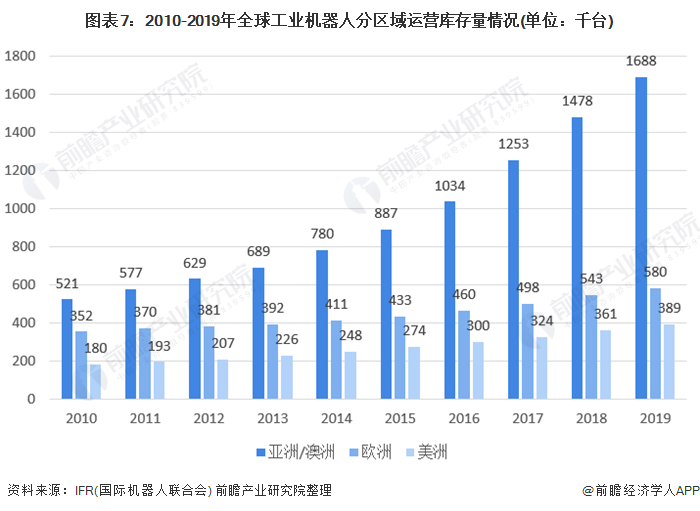

Asia/Australia is the market with the largest deployment of industrial robots. In 2019, the inventory of industrial robots was 1.688 million units. Among them, China's operating inventory increased by 21%, reaching about 783,000 units in 2019. Japan reached about 355,000 units, accounting for 12% of total sales. India set a new record of about 26,300 units, an increase of 15%.

In 2019, Europe’s operating inventory reached 580,000 units, an increase of more than 7%. Germany is still the main user, with an operating inventory of approximately 221,500 units, which is about three times the inventory in Italy (74,400 units), 5 times the inventory in France (42,000 units), and about 10 times the inventory in the United Kingdom (21700 units)...

In 2019, the operating inventory of industrial robots in the Americas was 389 thousand units. Among them, the United States is the largest user of industrial robots in the Americas, with approximately 293,200 units, an increase of 7%. Mexico ranks second with 40,300 units, an increase of 11%; followed by Canada with approximately 28,600 units. An increase of 2%.

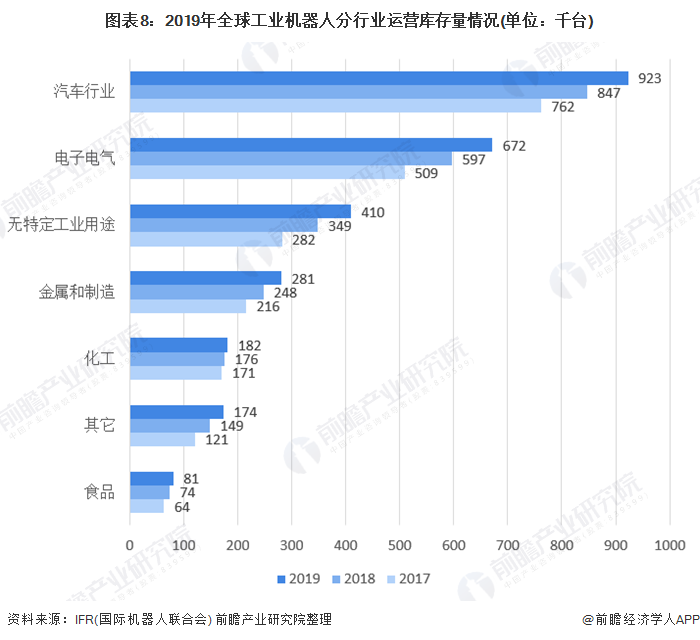

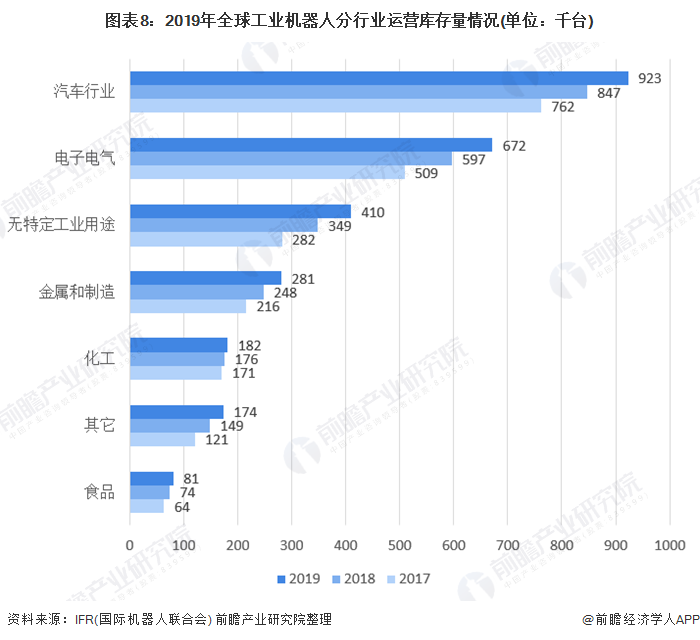

The largest number of industrial robots deployed in the automotive industry

In terms of different industries, in 2019, the three industries with the largest number of global industrial robots deployed are automotive, electrical and electronic, metal, and manufacturing. Among them, the operating inventory of industrial robots in the automotive industry reached 923,000 units; the inventory of robots deployed in the chemical and food industries It is also considerable.

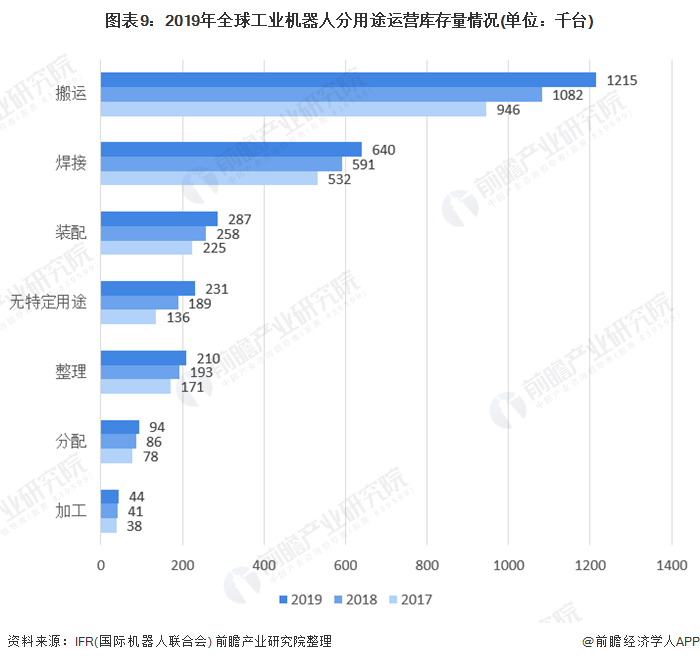

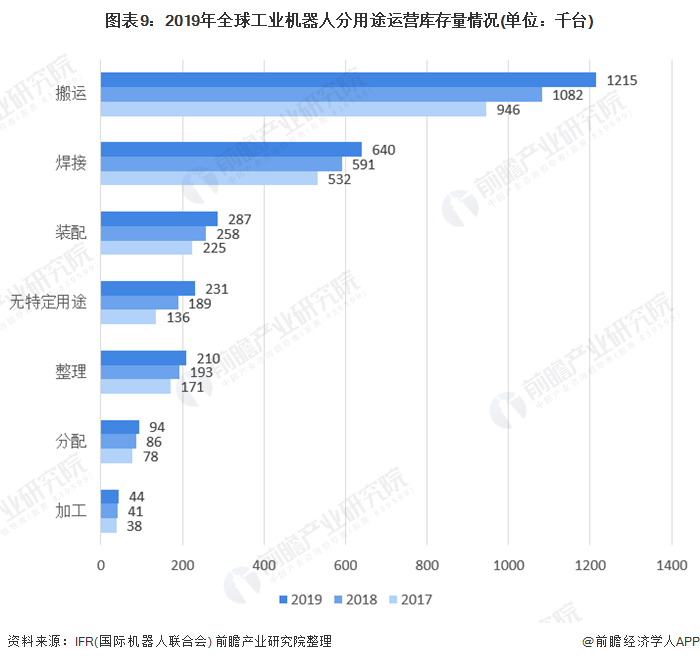

The most deployed use of industrial robots in the world is handling

In terms of use, in 2019, the most deployed use of industrial robots is handling, with a total operation of 1.215 million units; followed by welding, with a total operation of 640,000 units; in addition, global industrial robots are widely used in the assembly, Sorting and distribution, etc.

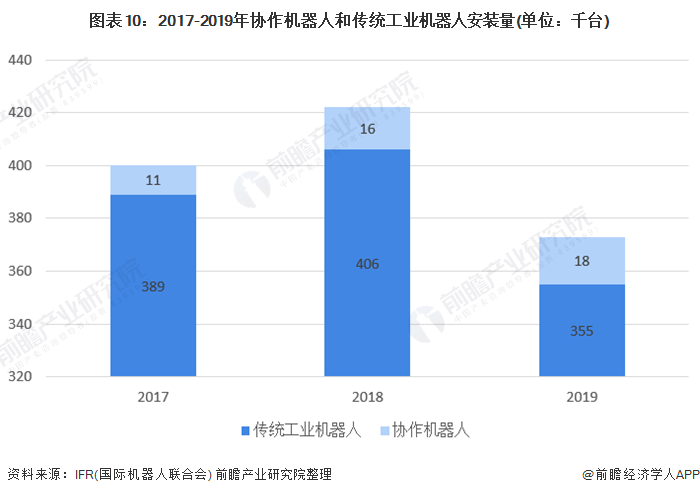

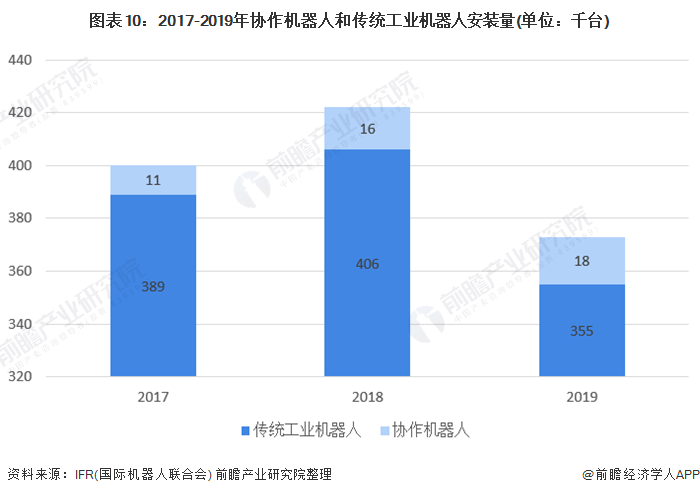

The number of co-robots is growing rapidly

At present, the application of human-machine collaboration is showing an upward trend. Among the newly installed (sold) industrial robots, the number of co-robots is increasing. The sales volume of co-robots in 2019 was 18,000 units, which was higher than the 16,000 units in 2018, and the growth rate was significant compared with 11,000 units in 2017.

This growth in sales performance is in sharp contrast with the overall trend of traditional industrial robots in 2019. As more and more suppliers introduce co-robots, the scope of application of this kind of robot is becoming wider and wider.

According to the latest report of IFR (International Federation of Robotics), in 2019, the global sales of new robots remained at a high level, with global shipments of 373,000 units. Compared with 2018, the decline was 12% year-on-year. The main reason for the decline was the continued downturn in the two major downstream industries: automotive and electrical/electronics. However, it was still the third-highest sales volume on record. The compound growth rate from 2014 to 2019 was 11%.

Industrial robots continue to integrate with emerging technologies such as big data, artificial intelligence, and 5G, pushing the industry into a fast track. From 2014 to 2018, the global sales of industrial robots showed an overall growth trend. In 2019, the global sales of industrial robots declined slightly, with sales of 13,800 million U.S. dollars, a decrease of 2,700 million U.S. dollars from the previous year, and a year-on-year decrease of 16.36%.

The Asia-Pacific region is the world's largest market for industrial robots

Due to the vigorous development of the automotive industry in developing countries such as China, Japan, and India, the Asia-Pacific region is the world's largest industrial robot producer and employer. In Asia, the share of newly installed robots accounts for about 2/3 of the global supply. In 2019, the sales of industrial robots in Asia/Australia reached 245,000 units; Europe is the second-largest market for industrial robots, with sales of 7.19 in 2019 Ten thousand units; the market share of industrial robots in the Americas is the smallest, with sales of 47,800 units in 2019.

From a national perspective, the global robot consumer market is highly concentrated. In 2019, sales in major countries such as China, Japan, the United States, South Korea, and Germany accounted for 73% of global sales. China is the main end-use market for industrial robots, with 141,000 new installations annually, followed by Japan and the United States with 49,900 and 33,000 units respectively.

Singapore and South Korea lead the world in installed density

From the perspective of the installed density of robots, the global installed density of industrial robots was 113 units per 10,000 people in 2019. Singapore and South Korea are the markets with the highest installed density of robots. The number of installed robots per 10,000 people reached 918 and 855, respectively. The number of the largest Chinese market is only 187 units, which is far behind the developed countries, and there is still much room for improvement in the future.

Asia/Australia holds the largest number of industrial robots

According to the latest statistics from the International Federation of Robotics (IFR), as of the end of 2019, the number of industrial robots in the world reached 2.72 million units, a year-on-year increase of 11.6%.

Asia/Australia is the market with the largest deployment of industrial robots. In 2019, the inventory of industrial robots was 1.688 million units. Among them, China's operating inventory increased by 21%, reaching about 783,000 units in 2019. Japan reached about 355,000 units, accounting for 12% of total sales. India set a new record of about 26,300 units, an increase of 15%.

In 2019, Europe’s operating inventory reached 580,000 units, an increase of more than 7%. Germany is still the main user, with an operating inventory of approximately 221,500 units, which is about three times the inventory in Italy (74,400 units), 5 times the inventory in France (42,000 units), and about 10 times the inventory in the United Kingdom (21700 units)...

In 2019, the operating inventory of industrial robots in the Americas was 389 thousand units. Among them, the United States is the largest user of industrial robots in the Americas, with approximately 293,200 units, an increase of 7%. Mexico ranks second with 40,300 units, an increase of 11%; followed by Canada with approximately 28,600 units. An increase of 2%.

The largest number of industrial robots deployed in the automotive industry

In terms of different industries, in 2019, the three industries with the largest number of global industrial robots deployed are automotive, electrical and electronic, metal, and manufacturing. Among them, the operating inventory of industrial robots in the automotive industry reached 923,000 units; the inventory of robots deployed in the chemical and food industries It is also considerable.

The most deployed use of industrial robots in the world is handling

In terms of use, in 2019, the most deployed use of industrial robots is handling, with a total operation of 1.215 million units; followed by welding, with a total operation of 640,000 units; in addition, global industrial robots are widely used in the assembly, Sorting and distribution, etc.

The number of co-robots is growing rapidly

At present, the application of human-machine collaboration is showing an upward trend. Among the newly installed (sold) industrial robots, the number of co-robots is increasing. The sales volume of co-robots in 2019 was 18,000 units, which was higher than the 16,000 units in 2018, and the growth rate was significant compared with 11,000 units in 2017.

This growth in sales performance is in sharp contrast with the overall trend of traditional industrial robots in 2019. As more and more suppliers introduce co-robots, the scope of application of this kind of robot is becoming wider and wider.

Previous Article: Which work scenarios are more suitable for deploying co-robots?

Next Article: Co-robots will be the vane of future industrial development