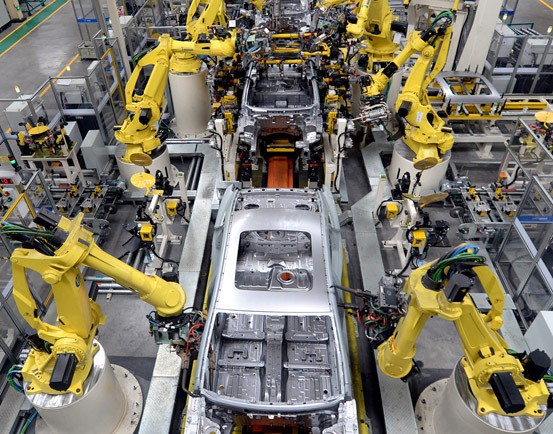

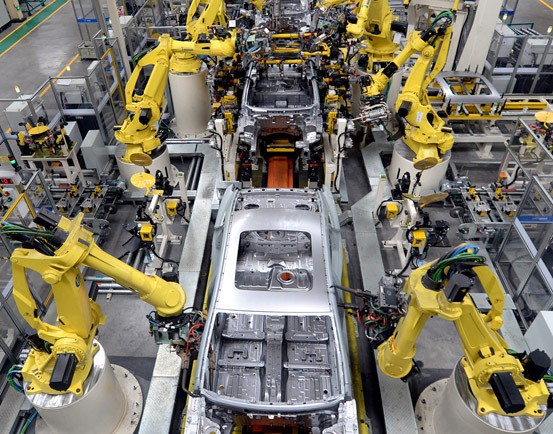

The robot industry in Shenzhen shows

Date:2020-06-10

The release of the White Paper on the Development of The Robot Industry in Shenzhen has become the annual "example dish" of the Robot Association of Shenzhen in the past five years. On May 29, under the guidance of shenzhen Advanced Institute of Chinese Academy of Sciences, Shenzhen Robot Association and Shenzhen new generation information and communication industry cluster jointly held the release ceremony of "White Paper on The Development of Shenzhen robot Industry in 2019" and the annual award ceremony of Shenzhen robot.

In the newly released White Paper, 2019's achievements are summed up in four words: steady growth. "As an important part of high-end equipment in Shenzhen's strategic emerging industry, the robot industry has shown continuous vitality in recent years. "Despite the macroeconomic impact of trade frictions and other factors, last year was marked by steady and high-quality growth."

The white paper starts with a set of figures: The industrial output value of the robot industry in Shenzhen reached 125.7 billion yuan in 2019, up 6.73 percent from 117.8 billion yuan in 2018; The number of companies reached 757, up 16.64% from 649 in 2018. It is reported that in order to make the data in the report more comprehensive and objective, the Municipal Robot Association has set up its own enterprise database and conducted statistical analysis by sampling survey of key enterprises.

It is worth mentioning that, unlike traditional methods to divide the robot industry into industrial robots and service robots, this white Paper divides it into industrial robots and non-industrial robots. The reason is that service robots in Shenzhen have emerged in multiple application scenarios. Non-industrial robots, represented by household service robots, commercial service robots, education robots, special robots, medical rehabilitation robots, etc., are gradually emerging. Mere "service robots" can no longer be generalized.

Shenzhen had 437 industrial robot companies, up 18.1 percent from 2018, accounting for 54.31 percent of the total, the white paper said. In 2019, the output value of industrial robots in Shenzhen reached 82.2 billion yuan, with a year-on-year growth of 2.33% compared with 2018. Although the output growth slowed down, the growth remained steady. The total industrial output value of non-industrial robots is 43.5 billion yuan, up 27.94% from 2018. Non-industrial robots continue to grow at a high speed, and their output value has exceeded one third of the total industrial output value of the robot industry in Shenzhen.

In addition, the white Paper pointed out that the city's robot industry is facing four trends. The first is that the trading environment brings more import substitution opportunities for local brands. The core link of Shenzhen industrial robot industry chain is more independent than other regions in China. Some local enterprises, such as Dazu Laser and Huichuan Technology, have the ability to develop and produce core components, so they can seize opportunities and seize market shares.

Second, the industry chain supports robots to enter the market segment faster. Relying on its huge 3C industry, Shenzhen has built the most complete robot industry chain in China. With its cost advantage and proximity to the market, Shenzhen can quickly respond to customer demands, which is conducive to the industry focusing on market segments.

Third, cluster cultivation drives the robot to take the lead in entering the 5G era. In February 2019, the CPC Central Committee and the State Council issued the Outline of the Development Plan for Guangdong, Hong Kong, Macao And Dawan District, proposing the development of a new generation of ICT industry clusters in Shenzhen. The Municipal Robotics Association is one of the branches of the shenzhen Advanced Research Institute, which has become the headquarters of the new generation of information and communication industry clusters through the open bidding of the Ministry of Industry and Information Technology.

Fourth, "new infrastructure" will accelerate the empowerment of artificial intelligence and other related technologies. 5G, industrial Internet, artificial intelligence, big data and other key fields will bring technical support to the development of the robot industry.

In the newly released White Paper, 2019's achievements are summed up in four words: steady growth. "As an important part of high-end equipment in Shenzhen's strategic emerging industry, the robot industry has shown continuous vitality in recent years. "Despite the macroeconomic impact of trade frictions and other factors, last year was marked by steady and high-quality growth."

The white paper starts with a set of figures: The industrial output value of the robot industry in Shenzhen reached 125.7 billion yuan in 2019, up 6.73 percent from 117.8 billion yuan in 2018; The number of companies reached 757, up 16.64% from 649 in 2018. It is reported that in order to make the data in the report more comprehensive and objective, the Municipal Robot Association has set up its own enterprise database and conducted statistical analysis by sampling survey of key enterprises.

It is worth mentioning that, unlike traditional methods to divide the robot industry into industrial robots and service robots, this white Paper divides it into industrial robots and non-industrial robots. The reason is that service robots in Shenzhen have emerged in multiple application scenarios. Non-industrial robots, represented by household service robots, commercial service robots, education robots, special robots, medical rehabilitation robots, etc., are gradually emerging. Mere "service robots" can no longer be generalized.

Shenzhen had 437 industrial robot companies, up 18.1 percent from 2018, accounting for 54.31 percent of the total, the white paper said. In 2019, the output value of industrial robots in Shenzhen reached 82.2 billion yuan, with a year-on-year growth of 2.33% compared with 2018. Although the output growth slowed down, the growth remained steady. The total industrial output value of non-industrial robots is 43.5 billion yuan, up 27.94% from 2018. Non-industrial robots continue to grow at a high speed, and their output value has exceeded one third of the total industrial output value of the robot industry in Shenzhen.

In addition, the white Paper pointed out that the city's robot industry is facing four trends. The first is that the trading environment brings more import substitution opportunities for local brands. The core link of Shenzhen industrial robot industry chain is more independent than other regions in China. Some local enterprises, such as Dazu Laser and Huichuan Technology, have the ability to develop and produce core components, so they can seize opportunities and seize market shares.

Second, the industry chain supports robots to enter the market segment faster. Relying on its huge 3C industry, Shenzhen has built the most complete robot industry chain in China. With its cost advantage and proximity to the market, Shenzhen can quickly respond to customer demands, which is conducive to the industry focusing on market segments.

Third, cluster cultivation drives the robot to take the lead in entering the 5G era. In February 2019, the CPC Central Committee and the State Council issued the Outline of the Development Plan for Guangdong, Hong Kong, Macao And Dawan District, proposing the development of a new generation of ICT industry clusters in Shenzhen. The Municipal Robotics Association is one of the branches of the shenzhen Advanced Research Institute, which has become the headquarters of the new generation of information and communication industry clusters through the open bidding of the Ministry of Industry and Information Technology.

Fourth, "new infrastructure" will accelerate the empowerment of artificial intelligence and other related technologies. 5G, industrial Internet, artificial intelligence, big data and other key fields will bring technical support to the development of the robot industry.

Previous Article: Why are co-robots more suitable for smart factories?

Next Article: Ground economy - The application of co-robots